Are you writing the West African Examination Council WAEC Internal/External exam, if yes you need the WAEC Financial Accounting Past Questions & Answers.

we at stcharlesedu.com has compiled a good number of Financial Accounting WAEC Past Questions in pdf.

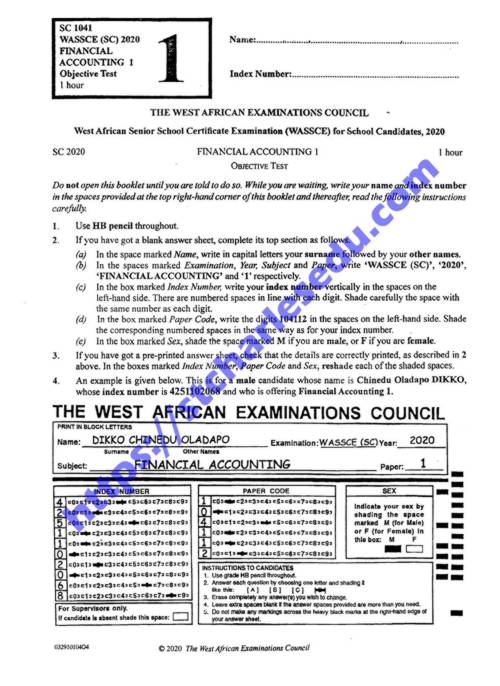

Financial Accounting 1 – Objective Test Questions

Financial Accounting 2 – Essay or Theory

Our research has confirm that candidate that uses West Africa Senior Secondary School Certificate Examination (WASSCE) Financial Accounting past questions to prepare for WAEC is ten times better than those who do not.

What others are downloading WAEC Past Questions for all Subjects

Table of Contents

SSCE WAEC Financial Accounting Objective Test Questions.

Financial Accounting 1 (Objective Test Questions)

1 hours

Use HB pencil throughout.

Answer all Questions

Each question is followed by four options lettered A to D. Find out the correct options for each question and shade in pencil on your answer sheet, the answer space which bears the same letter as the option you Chosen. Give only one answer to each question. An example is given below

Which of the following documents is used to deposit money into a current account?

A. Passbook

B. Paying-in slip

C. Cheque book

D. Credit card

The correct answer is Paying-in slip, which is lettered B and therefore answer space B would be shaded.

[A] [ B ] [C] [ D ]

Think carefully before you shade the answer spaces; erase completely any answer you wish to change.

Do all rough work on this questions paper.

Now answer the following questions.

A debit entry in a fixed asset account represents

A. an increase in the fixed asset account.

B. a decrease in the fixed asset account.

C. a profit on disposal of the fixed asset.

D. a loss on disposal of the fixed asset.

When bank charges are discovered in a bank statement, the adjustment is effected in the

A. bank reconciliation statement.

B. cash book.

C. suspense account.

D. bank loan account.

The double entry for interest on drawings by a partner is: debit

A. Partners Current Account; credit Appropriation Account.

B. Profit and Loss Account; credit Interest Account.

C. Appropriation Account; credit Partner’s Current Account.

D. Interest Account; credit Profit and Loss Account.

A credit purchase of GHe 200 from Osae was posted to the account of Osei. This is an error of

A. principle.

B. commission.

C. omission.

D. original entry.

Use the following information to answer questions 5 and 6.

Provision for doubtful debts Le 1,000 Cr

Bad debts Le 500 Dr

Debtors Le 50,000 Dr

Additional bad debts to be

written off Le 500

New provision for doubtful debts to stand at 5% of debtors

The net figure for debtors in the balance sheet is

A. Le 47,025.

B. Le 46,550.

C. Le 45,600.

D. Le 45.500.

The provision for doubtful debts to be charged to Profit and Loss Account is

A. Le 2,500.

B. Le 2,475.

C. Le 2,450.

D. Le 1,000.

An office equipment bought for use was found to be defective and returned to the supplier.

The subsidiary book to record this transaction is

A. returns outwards journal.

B. returns inwards journal.

C. purchases journal.

D. general journal.

In a situation of incomplete records, profit is determined as

A. closing capital – drawings + opening capital.

B. closing capital – drawings – opening capital.

C. closing capital + drawings – opening capital.

D. closing capital + drawings + opening capital.

The document which serves as the authority to incur expenditure in public sector is

A. warrant.

B. vote.

C. budget.

D. voucher.

A debit balance of GHé 420 on the purchases. ledger control account means that the

A. trade creditors were overpaid by GHe 420

B. trade creditors are owed GHe 420

C. goods returned to trade creditors amounted to GHe 420

D. total supplies from trade creditors amounted to GHe 420

A total et D 9,160 was entered in the sales account as D 9,610.

To correct this error: debit

A. Sales Account D 450; credit Sales Day Book D 450

B. Sales Day Book D 450; credit Sales Account D 450

C. Sales Account D 450; crédit Suspense Account D 450

D. Suspense Account D 450; crédit Sales Account D 450

Use the following information to answer questions 12 to 14.

Ata, Bubu and Chikum were in partnership sharing profits and losses in proportion to their capital contributions:

Capital Drawings

N N

Ata 40,000 8,000

Bubu 30,000 5,000

Chikum 20,000 -

Net profit for the year was N 40,500 and the interest on capital was 5% per annum.The profit available for sharing by the partners is

A. N 90,000.

B. N 40,500.

C. N 36,000.

D. N 27,500.

The balance in Chikum’s Current Account is

A. N 14,000.

B. N 9,000.

C. N 8,000.

D. N 4,000.

Bubu’s share of profit is

A. N 16,000.

B. N 12.000.

C. N 8,000.

D. N 4,000.

Recognition of profit when goods are sold and the buyer takes ownership of them is in line with

A. realization concept.

B. matching concept.

C. business entity concept.

D. going concern concept.

The purpose of preparing trading account is to ascertain

A. average stock.

B. gross profit.

C. cost of goods sold.

D. cost of goods available for sale.

A trader adds 25% on cost as profit. The profit on sales of $300,000 would be

A. $ 75,000

B. $ 60,000

C. $ 50,000

D. $ 25,000

The accounting concept which distinguishes an enterprise from its owners is

A. money measurement concept.

B. dual aspect concept.

C. going concern concept.

D. business entity concept.

Eze introduces his private car into his business. The aspect of accounting equation of the business that would be affected are

A. Assets and Capital.

B. Capital and Profit.

C. Liabilities and Assets.

D. Capital and Liabilities.

Debtors and credit sales for a period are

D 120,000 and D 600.000 respectively. The debtor’s payment period would be

A.1825 days.

B.365 days.

C.73 days.

D.5 days.

Use the following information to answer questions 21 to 23

Receipts and payments Accounts of Abaluare Youth Club for the year ended 31st December 2018

| N | N | ||

| Balance b/f | 650,00 | Wages and salaries | 24,00.000 |

| Subscriptions | 9,660,000 | Rent and rates | 600,000 |

| Annual dance tickets | 1,500,000 | Anniversary dance expenses | 955,000 |

| Donation | 800,000 | Travelling expenses | 140,000 |

| Kitchen equipment | 4,000,000 | ||

| Balance c/d | 4,515,000 | ||

| 12,610,000 | 12,610,000 |

Subscriptions credited to Income and Expenditure Account for 2018 was

A. N 9,990,000.

B. N 9,690,000.

C. N 9,630,000.

D. N 9,330,000.

Total expenses debited to Income and Expenditure Account for 2018 was

A.N 12,610,000.

B.N 8,095,000.

C.N 4,515,000.

D.N 4,095,000.

The surplus for the year 2018 was

A. N 7,865,000.

B. N 7,535,000.

C. N 5,845,000.

D. N 5,235,000.

A non-cash expense chargeable against profit and loss account is

A. insurance payable.

B. debenture interest.

C. provision for doubtful debts.

D. rent and rates.

The cost incurred on goods purchased for production which can be traced to a particular unit is classified as

A. direct labour.

B. direct expenses.

C. direct materials.

D. factory overhead.

Use the following information to answer questions 26 and 27.

A manufacturing company’s cost of production was D 200,000. The finished goods were transferred to the warehouse at D 220,000.

At the end of the year, 9% of these goods were still in stock.

The value of closing stock of finished goods in the trading account is

A. D 37.800.

B. D 20.000.

C. D I9.S00.

D. D. 18.000.

The value of closing stock of finished goods that would be shown in the balance sheet is

A. D 37,800.

B. D 20,000.

C. D 19,800.

D. D 18,000.

Items shown in manufacturing account include

I. Purchases of raw materials

II. Purchases cf finished goods

III. Carriage inwards

IV. Carriage outwards

A. I and II only.

B. I and III only.

C. I, II and III only.

D. I. III and IV only.

Use the following information to answer questions 29 to 31.

Kwamenah bought goods worth Le 50,000 from Doe and Sons Limited on the following terms:

3% trade discount;

10% cash discount.

Kwamenah retumed defective goods worth Le 8,000 the next day and made payment for the remaining goods on the due date.

The cash paid by Kwamenah was

A. Le 43,650.

B. Le 43,500.

C. Le 37,800.

D. Le 36,660.

Kwamenah would record the 10% discount in the

A. sales journal.

B. cash book.

C. purchases journal.

D. journal proper.

Want more Financial Accounting Objective Test Questions like this?

Get the Complete WAEC Financial Accounting Exam Past Questions and Answers (Obj and Essay) in PDF Format from us.

Financial Accounting WAEC Essay Questions

PAPER 2

This paper consists of two sections A and B. Answer two questions from Section A and three questions from Section B.

THEORY SECTION A

1.(a)State three distinguishing features between reserves and provisions.

1.(b)State two types of reserves with an example each.

2.Describe:

(i) Bank statement:

(ii) Bank reconciliation statement.

(b) List eight items that cause disagreement between cash book and bank statement balances.

3.Explain the following:

(i)fictitious assets;

(ii) intangible asset:

(iii) real accounts:

(iv) nominal accounts:

(v) long-term liabilities.

4.Explain:

(a)three errors that would affect the agreement of a trial balance;

(b)a suspense account.

SECTION B.

Financial Accounting Practice

Want more Financial Accounting Theory Questions like this?

Get the Complete WAEC F/A Exam Past Questions and Answer (Obj and Essay) in PDF Format from us.

Free Financial Accounting WAEC Past Questions Download

Click to Download your free WAEC Past Question on Financial Accounting 1 and 2

Link 1: WASSCE Financial Accounting Questions Booklet

Link 2: WASSCE Financial Accounting Questions Booklet

How to Get WAEC Past Questions on Financial Accounting

To get the complete and more recent copy of the West Africa Examination Council WAEC Past Questions and answer on Financ. Acct

Take Note of the following step

Make a Call

Call or whatsapp us on 08051311885 for the account number to make payment and how to received your complete copy of the past questions to be sent directly to your email address or whatsapp number.

Mode of Payment.

Mobile Transfer or Direct Bank Deposit.

After Payment

send us the following

Depositor Name:

Name of Product Paid for:

Valid email address.

DELIVERY ASSURANCE

We will deliver the past question to you 10 mins after confirmation of payment to the email you will send to us.