Are you writing the National Examination Council NECO Internal/External exam, if yes you need the NECO Financial Accounting Past Questions.

we at stcharlesedu.com has compiled a good number of Financial Accounting NECO Past Questions in pdf.

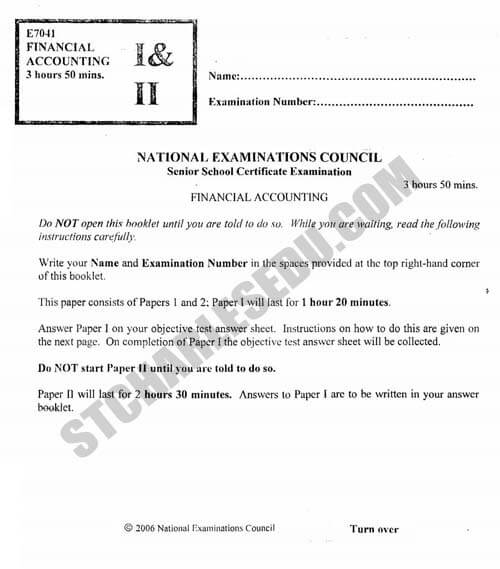

Financial Accounting Paper 1 – Objective Test Questions

Financial Accounting Paper 2 (Book-Keeping & Account) – Theory/Practice of Financial Accounting

Our research has confirm that candidate that uses National Examination Council Financial Accounting past questions to prepare for NECO is ten times better than those who do not.

What others are downloading NECO Past Questions for all Subjects

Like our Facebook Page to Download Free NECO Past Questions

Table of Contents

NECO Financial Accounting Objective Questions

Answer Paper 1 on your Objective test Answer Sheet.

This paper will Last for 1 hour 20 minutes.

Use HB pencil throughout.

Answer all Questions

Each question is followed by Five options lettered A to E.

Find out the correct option for each question and shade in pencil on your answer sheet, the answer space which bears the same letter as the option you have chosen.

Give only one answer to each question

1. The art of recording, classifying, summarizing and interpreting of financial transactions is known as

A. accounting.

B. book-keeping.

C. calculating.

D. data processing.

E. trial balance.

2. The following are the main objectives of book-keeping EXCEPT to show the

A. cost of the ledger book.

B. financial position of a business as at a certain date.

C. result of business transactions.

D. value of assets and liabilities.

E. value of purchases and sales.

9. Business B’s profit or loss for the period is

A. N5,000

B. N4,500

C. N4,200

D. N3,500

E. N3,000

10. The profit or loss for Business C is

A. Nl,700

B. N1,800

C. N1,000

D. N500

E. N400

11. Business D’s profit or loss for the trading period is

A. N1,000.

B. N700.

C. N600.

D. N500.

E. N400.

12. When a current account is opened,the bank provides the customer with a……book

A. bank

B. cash

C. cheque

D. pass

E. report

Use the following information to answer questions 13-16.

Ifeanyi and Kudu were in partnership sharing profits and losses in the ratio of 3:2. Their respective capitals were N4,000 and N2,000, and their drawings, N1,800 and N1.200. Before charging 5% interest on the capitals, the profit was N5.400 and interest on drawing was 5%

13. What is Ifeanyi’s share of profit?

A. N3,250

B. N3,200

C. N3,180

D. N3,150

E. N3,000

14. What is Kudu’s share of profit?

A. N3,160

B. N3,100

C. N2,340

D. N2,220

E. N2,100

15. What is the balance on Ifeanyi’s current account?

A. N3,350

B. N3,150

C. N1,460

D. N1,400

E. N200

16. What is the balance on Kudu’s current account?

A. N2,200

B. N2,100

C. N1,460

D. N940

E. N100

17. The components of prime cost are the following EXCEPT

A. direct expenses.

B. direct wages.

C. factory overheads.

D. raw materials.

E. royalty.

18. Production cost is equal to

A. direct cost + prime cost.

B. opening stock of goods + general expenses.

C. prime cost + cost of goods sold.

D. prime cost + production overheads.

E. production overheads + distribution expenses.

19. A classified summary of the balances remaining in the ledger after the preparation of profit and loss account is known as

A. balance sheet.

B. balancing ledger.

C. journal proper.

D. trading account.

E. trial balance.

Use the following information to Answer questions 20-23.

Raw materials:

Stock 1/1/2001 4,500

Purchases 30,000

Stock 31/12/2001 6,000

Wages:

Direct 34,200

Indirect 10,800

Factory expenses:

Rent 18,000

Insurance 6,750

Work in Progress:

01/01/2001 3,750

31/12/2001 3.000

20. What is the cost of raw materials consumed?

A. N34,500

B. N31,500

C. N30,000

D. N28,500-

E. N18,500

21. The prime cost is

A. N68,700.

B. N65,700.

C. N62,700.

D. N58,700.

E. N48,700.

22. The amount of factory overhead is

A.N42,300.

B.N31,800.

C.N28,800.

D.N21,000.

E.N18,000.

23. The cost of goods manufactured is

A. N101,250.

B. N98,250.

C. N94,500.

D. N91,500.

E. N62,700.

24. A provision for bad and doubtful debts is a/an

A. amount of loss from trading activities.

B. amount set out of profit.

C. estimate of the possibility of bad debts arising in a future accounting period.

D. expense of the business to be paid for in cash.

E. loss in value of assets and liabilities.

Questions No 25-60 Omitted/Removed

National Examination Council Financial Accounting Questions

FINANCIAL ACCOUNTING (Book-keeping & Accounts)

This paper consists of TWO Sections: Sections A and B.

Answer FIVE questions: TWO questions from Section A and THREE questions from Section B.

All questions carry equal marks.

All calculations must be shown.

Candidates should ensure neatness and accuracy.

This paper will last for 2 hours 30 Minutes.

NECO Financial Accounting Theory Questions

SECTION A

(THEORY OF FINANCIAL ACCOUNTING)

Answer TWO questions from this section

1(a) What is Single Entry? 2marks

(b) Mention FIVE problems associated with Single Entry Bookkeeping. 5marks

(c) State FOUR reasons why business organizations need to reconcile their cash book with bank statement balances. 8marks

2(a) Mention FIVE items to be found in Partner’s Current Account. Smarks

(b) State FIVE clauses that will be applied in the absence of a Partnership Deed. 10marks

3(a) List THREE items included in the appropriate heading of a Balance Sheet. 3marks

(b) Explain the arrangement of Balance Sheet items in their order of:

(i) permanence and

(ii) liquidity. 6marks

(c) Mention THREE advantages of the Computer 6marks

4 Explain the following accounting terms:

(a) Fictitious assets; 3marks

(b) Invoice; 3marks

(c) Source document; 3marks

(d) Transaction; and 3marks

(e) Voucher. 3marks

Financial Accounting NECO Practice Questions

SECTION B.

Practice of Financial Accounting

Answer Three Questions from This Section

Questions No 5-9 Removed/Omitted.

9. Ado, Ihuoma and Yemi entered into a joint venture for dealing in second-hand clothing materials.

Profit and losses are to be shared among Ado, Ihuoma and Yemi in the ratio of 4:3:3.

The following transactions took place in the month of December, 2003.

December 1. Ado rented premises for N10,000.

December 3. Ihuoma supplied jeans costing N40,000.

December 7. Ado engaged labour for offloading jeans N5,000.

December 9. Ihuoma paid for transport N6,500.

December 12. Ado paid for lighting and heating of the business premises N3,000.

December 15. Ado paid further sundry expenses N5,200.”

December 25. Yemi paid selling expenses N15,000.

December 30. Yemi received cash from sales of jeans material N100,000.

You are required to show:

i. Memorandum Joint Venture Account, and

ii. Joint Venture Accounts in the books of each of the venturers. 15 marks

Free Financial Accounting NECO Past Questions Download

Click to Download your free NECO Past Question on Financial Accounting Paper 1 and 2

SSCE NECO Financial Accounting Questions Booklet

How to Get National Examination Council NECO Financial Accounting Past Questions

Make a Call

Call or whatsapp us on 08051311885 for the account number to make payment and how to received your complete copy of the past questions to be sent directly to your email address or whatsapp number.

Mode of Payment.

Mobile Transfer or Direct Bank Deposit.

After Payment

send us the following

Depositor Name:

Name of Product Paid for:

Valid email address.

DELIVERY ASSURANCE

We will deliver the past question to you 10 mins after confirmation of payment to the email you will send to us.

Free Financial Accounting NECO Past Questions Download by Charles Obaleagbon on Scribd